Modular homes are built in sections and meet state/local building codes. Manufactured homes are built on a steel chassis to federal HUD standards. The difference impacts financing, insurance, zoning, and long-term value, especially in Florida’s storm-prone environment.

Modular vs Manufactured Homes in Florida: What Really Sets Them Apart

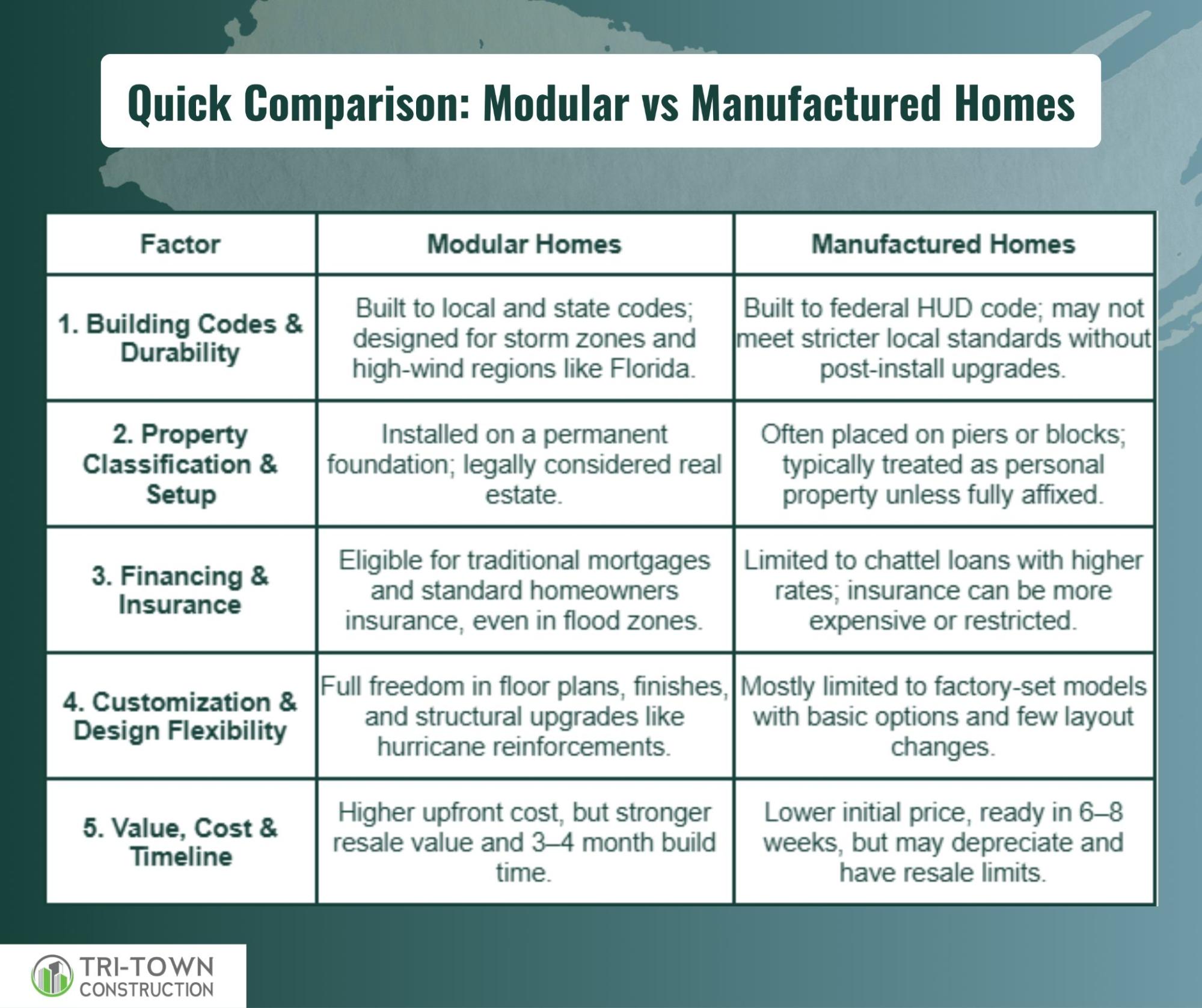

Modular and manufactured homes are both prefab, but in Florida, their differences impact storm safety, financing, insurance, and long-term value. Here’s a quick breakdown:

- Modular = real property: Qualifies for conventional loans, built to local codes

- Manufactured = personal property: Limited financing, built to HUD code

- Modular is permanently installed: Better zoning approval, higher resale

- Manufactured may sit on piers: Lower upfront cost, but may depreciate

- Modular offers full customization from layout to luxury upgrades

- Manufactured is mostly pre-designed, which means fast delivery but limited options

If you’re buying in a flood zone, want hurricane resistance, or care about long-term value, these differences aren’t just technical, they’re make-or-break.

And if you’re weighing your first big build or a Florida relocation, you’ll want to keep reading. What’s ahead could save you time, money, and plenty of headaches.

The Core Difference Between Modular and Manufactured Homes, And Why It Matters

Modular and manufactured homes are often confused and called “prefab.” But in Florida, their building rules, zoning approval, and long-term value are very different.

1. Modular Homes

Modular homes are built in sections in a factory and assembled on a permanent foundation.They follow the same state and local building codes as site-built homes.

Once completed, they’re classified as real property, qualifying for conventional loans, standard insurance, and full zoning approval.

Structurally and visually, they’re nearly indistinguishable from traditionally built homes.

2. Manufactured Homes

Manufactured homes are built entirely in a factory on a steel chassis, delivered in one piece, and follow HUD federal codes.

While some are placed on permanent foundations, many are not, so they’re often treated as personal property by lenders and local authorities.

This limits financing, insurance, and resale options and may trigger zoning restrictions in Florida communities.

If your goal is long-term value, modular homes are the more stable choice. Manufactured homes may cost less upfront, but they carry limitations that can affect your next steps.

10 Ways Modular and Manufactured Homes Differ (And What It Means for You)

Understanding the difference between modular and manufactured homes goes far beyond how they’re built.

From financing and insurance to zoning and resale, these differences impact every stage of homeownership, especially in Florida.

1. Building Codes and Compliance

The codes a home must follow impact its safety, insurability, and whether it’s even allowed in your chosen neighborhood. In storm-prone states like Florida, this one difference can make or break a build.

- Modular: Built to meet local and state building codes for the home’s final destination, modular homes follow the same standards as traditional site-built houses, including wind, flood, and structural regulations.

- Manufactured: Constructed under federal HUD codes that apply nationwide, these homes do not adapt to local building or weather conditions unless additional upgrades are added after delivery.

Modular homes hold up better in zoning reviews and long-term durability. They are often approved faster and more widely in Florida communities.

2. Construction and Materials

The way a home is put together, and what it’s made of, affects its strength, energy efficiency, and how it performs during transport and over time. This becomes especially important in Florida’s heat, humidity, and storm season.

- Modular: Designed in sections, each module is built with extra structural support to survive transport and Florida’s strict hurricane zones, often using more lumber than site-built homes.

- Manufactured: Built as a single unit in a factory using lighter materials, thinner walls, and standardized components, these homes are designed for efficiency, not necessarily for high-wind resistance.

Modular builds offer better storm resistance and insulation, critical in Florida. They hold up better in extreme weather and carry fewer post-installation risks.

3. Foundation and Permanence

How a home is placed on the land affects more than stability, it determines how it’s taxed, financed, insured, and even whether it qualifies as real estate or personal property.

- Modular: Always installed on a permanent foundation such as a concrete slab, crawlspace, or pilings, making them legally and physically permanent structures tied to the land.

- Manufactured: May be placed on blocks, piers, or permanent foundations, but even then, the steel chassis usually remains, and many are still classified as movable or personal property.

Only modular homes are treated as true real estate from day one. This opens the door to better lending, insurance, and resale opportunities.

4. Cost Per Square Foot

Upfront cost matters, but it’s just one part of the financial picture. What you save on day one might cost you later in financing, insurance, or resale value, especially if the structure can’t be easily upgraded.

- Modular: Average pricing runs between $80 and $150 per square foot, depending on the finish level, layout, and any site-specific work required for hurricane or flood readiness.

- Manufactured: Base models start around $40 to $70 per square foot, but those savings can shrink when adding premium finishes, transport upgrades, or post-delivery improvements.

Manufactured is cheaper upfront, but modular delivers long-term value. Over time, modular homes tend to appreciate, while manufactured homes may not.

5. Financing Options

View this post on Instagram

The way a home is financed affects monthly costs, approval speed, and long-term equity. This is especially important for Florida buyers navigating storm zone lending restrictions or trying to combine land and build costs.

- Modular: Modular homes qualify for conventional mortgages, FHA, and VA loans, giving buyers access to competitive rates and broader lender options, even in high-risk flood or coastal zones.

- Manufactured: Financing is often limited to personal property or “chattel” loans, which typically come with higher interest rates, shorter terms, and fewer refinancing options.

Modular homes offer more flexible and affordable financing paths. This makes them easier to purchase and invest in for the long term.

6. Appraisal and Resale Value

Whether you’re building a forever home or planning to sell in the future, resale value matters. What your home is worth later depends heavily on how it’s classified and perceived by the market.

- Modular: Because they’re classified as real property and built to code, modular homes appraise like site-built homes and often follow local market trends in appreciation.

- Manufactured: Unless permanently affixed to owned land, manufactured homes often depreciate over time and may be appraised more like vehicles than homes.

Modular homes maintain or gain value in most Florida markets. Manufactured homes, in contrast, typically lose value unless carefully sited and maintained.

7. Customization and Design Flexibility

A home should reflect your lifestyle, not just what’s available on a sales lot. Customization isn’t just about aesthetics, it also impacts functionality, efficiency, and future resale.

- Modular: Offers high design flexibility before construction begins, allowing for custom layouts, rooflines, architectural styles, hurricane-resistant upgrades, and high-end finishes like gourmet kitchens or oversized windows.

- Manufactured: Often comes with pre-set layouts and limited upgrade options; most buyers choose from completed models with little room for design or structural changes.

Modular homes can be tailored to specific needs and preferences. Manufactured homes trade customization for convenience and speed.

8. Insurance and Risk Perception

View this post on Instagram

Insurability plays a big role in cost of ownership, especially in Florida where storms and flood zones make insurers cautious. The structure type can significantly affect coverage availability and premiums.

- Modular: Typically insured just like site-built homes, with standard homeowners insurance policies covering structure and contents, including hurricane and flood endorsements where applicable.

- Manufactured: Often require specialized or higher-risk policies, especially if not on permanent foundations, with limited options in certain Florida counties.

Modular homes are easier to insure and often cost less over time. Manufactured homes may face higher premiums or limited coverage in high-risk areas.

9. Zoning and Neighborhood Restrictions

Not every property allows every type of home. In fact, some Florida communities or HOAs place limits on certain housing classifications, making zoning research essential before you build or buy.

- Modular: Accepted in nearly all residential zones and neighborhoods, including those that only allow site-built homes, due to their compliance with local code and appearance.

- Manufactured: Often restricted to specific areas or parks; some HOAs or municipalities outright prohibit manufactured housing due to perceived value concerns.

Modular homes face fewer barriers during the zoning and permitting process. Manufactured homes may be rejected by HOAs or restricted by local ordinances.

Helpful Resource → Can You Build a House on Agricultural Zoned Land in Florida?

10. Construction Timeframe

Time is a key consideration, especially after storms or if you’re balancing temporary housing. Understanding how long each process takes helps manage expectations and plan ahead.

- Modular: Typically completed in 3 to 4 months, including factory build and on-site assembly, which can proceed simultaneously with site work and permitting.

- Manufactured: Ready within 6 to 8 weeks, with most of the construction done in the factory and only basic site prep and utility hookups needed afterward.

Manufactured homes offer a quicker move-in timeline. Modular homes strike a balance between speed and structural quality.

Choosing between modular and manufactured homes isn’t just about specs, it’s about fit. Now that you know how they compare, let’s look at which one aligns with your lifestyle and goals.

Which One’s Right for You? Let’s Break It Down by Lifestyle and Goals

The right home depends on your priorities, whether that’s customization, speed, financing, or long-term value. Here’s how each option fits different needs.

Modular Homes Are Ideal For…

If you want a long-term, storm-ready home built to your standards, modular is the clear winner.

- Building a permanent, long-term home in Florida with full zoning approval

- Homeowners seeking high-end finishes, flexible layouts, and design freedom

- Buyers in flood zones who need FEMA compliance and easier insurance

- Families wanting a resilient structure that builds equity over time

- Anyone frustrated with delays, budget overages, or poor contractor work

If you’re looking for control, comfort, and value, modular delivers a better return over time.

Manufactured Homes Might Fit If…

For those focused on speed, simplicity, and a lower price point, manufactured may offer a workable option.

- You need quick, affordable housing with minimal upfront planning

- Your land is in a mobile home park or unzoned area

- You’re comfortable with basic layouts and limited customization

- You’re downsizing, relocating, or planning a short-term stay

- Long-term equity isn’t a priority and zoning restrictions aren’t an issue

With clear expectations, manufactured homes offer convenience, but they come with trade-offs in flexibility, financing, and resale.

Your ideal home choice comes down to how long you plan to stay and what you expect it to deliver over time. Whether its stability or speed, understanding the trade-offs makes the decision clearer.

Why Modular Homes Stand Out in Florida

When you weigh it all, building codes, financing, resale, customization, and long-term value, modular homes clearly come out ahead.

Especially in Florida, where storm safety, flood zone compliance, and strict permitting rules are non-negotiable, modular homes offer the peace of mind and performance most homeowners need.

They aren’t just a middle ground between site-built and manufactured, they’re a smart, resilient choice built for the realities of Florida living.

If you’re ready to move forward with a modular home that’s built to handle hurricanes and tailored to your lifestyle, Tri-Town Construction can help.

Our team specializes in storm-ready modular builds designed specifically for Southwest Florida’s climate, codes, and communities.